Formalising smallholder agriculture and agri-business: what the evidence says

I’m a little late posting this, but I think the findings of this study I conducted on the formalisation of smallholder agriculture and agri-business are quite relevant and interesting.

I was commissioned by the DFID-funded Business Environment Reform Facility to review the evidence available on how business environment reform (BER) can support the formalisation of smallholder agriculture in developing countries.

The final report, which I co-authored with Dan Aylward from KPMG in London can be found HERE.

This research confirms that there is no clear line separating informal and formal firms. The transition from informality to formality is not binary. Informality can range from survivalist, livelihood-based enterprises to growth-oriented enterprises, and even to medium-sized firms operating below the tax radar. Firms which are more formal have different characteristics from those which are more informal.

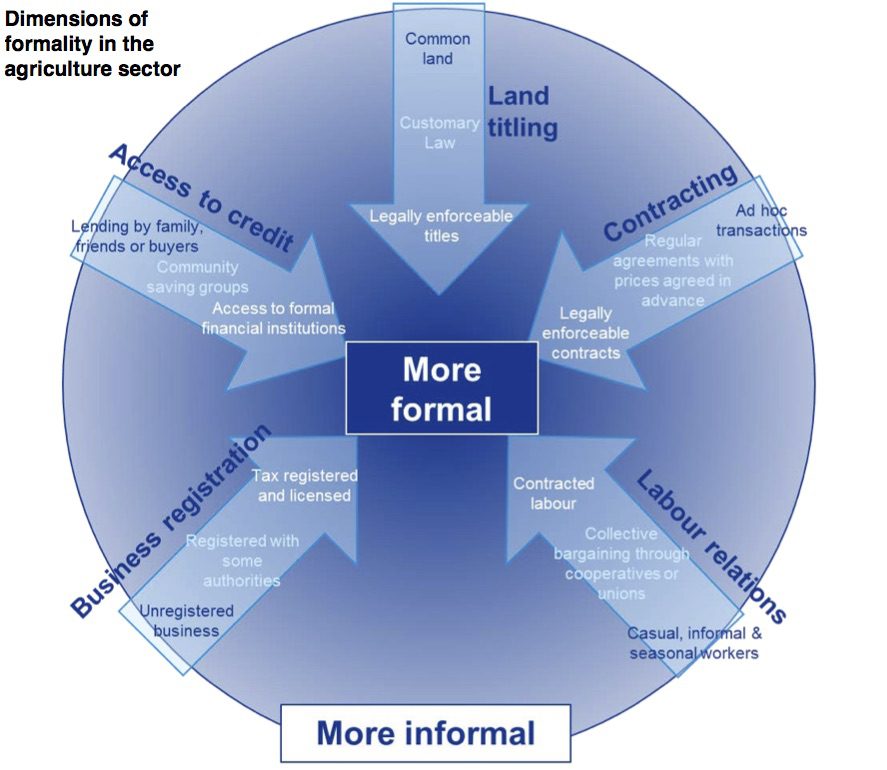

Adapting the Donor Committee for Enterprise Development Guidelines (2008) ‘functional areas’ of the business environment, we developed a set of dimensions of formality for smallholder farms and agri-businesses in the rural economy. These dimensions are based on our review of the literature — see the diagram below:

- Formalisation of land titles: Many smallholder farmers do not have formal legal rights to their land and the formal legal system may operate in parallel to customary law and informal land rights. Several BER programmes focus on formalisation of land titles and securing access to land rights, often assuming this will facilitate access to credit and incentivises investment.

- Access to formal credit: Many informal small-holder farmers lack access to formal financial services and credit facilities. This gap in the market is often compensated with informal lending by friends, family or purchasers. Partial formalisation may include development of community savings groups. Business registration and record keeping may facilitate access to credit, while land titling (collateral) and formal contracts may open up investment opportunities. However, direction of causality may be two way.

- Contracting: Rural agriculture is often conducted through informal agreements between buyers and sellers and at market places. Quality and hygiene standards may be variable and traceability limited, which prevents smallholder farmers from taking advantage of value chains. Formal contracts may provide security regarding prices, embed quality standards and encourage investment.

- Business registration: While formal business registration is not an end in itself, evidence from other sectors suggests it may encourage growth by integrating into more advanced value chains and providing access to credit. However, it can also bring with it administrative burdens disproportionate to the benefits. Business registration often includes tax registration (e.g. creation of a tax identification number). In many cases, this has negative impacts because informal firms are cautious of the implications this will have on their future revenues and costs.

- Formalisation of labour relations: Most agricultural work will be seasonal and workers often casual and informal. This is a cause for concern for many development agencies, although the sheer abundance of this form of labour suggests there is no quick fix and there are implications for businesses from increasing labour market rigidities.

Overall, this study found there are significant gaps in the objective evidence on how BER influences formalisation among smallholder farmers and in agribusiness.

While there is a great deal of guidance and general advice on these areas, and broad agreement that the high levels of informality in this sector demand attention, there is scant evidence on what BER has achieved. Most evidence comes from urban settings.

Many agricultural support programmes do not explicitly target formalisation. Instead, they facilitate the transition of smallholder farmers towards formality on one or more of the dimensions in our framework described above.

Much of the ‘evidence’ in this field is based on logical assertions rather than primary scientific research or evaluations. In many areas, a better understanding of the constraints faced by smallholder farmers and agribusinesses is required.

Because the primary evidence is thin, many programmes are designed based on the dogma that formalisation leads to improved productivity and growth. In many cases, it appears that an enabling business environment is necessary, but not sufficient for stimulating growth. This applies to both reforms to the business environment and value chain interventions.

Supporting the informal sector

A formal sector that crowds out the informal sector may be beneficial, provided the growing formal sector brings with it benefits such as higher productivity, improved incomes and better quality of jobs. However, the opposite may not be true. Support to the informal sector may be to the detriment of the formal sector, as productive resources (i.e., labour and capital) are redirected back to the informal sector. This could lead to the informalisation of jobs.

Despite this risk, it is commonly argued that, given the size and importance of the informal sector in rural economies, it is important to consider the informal sector as a potential for growth and to work with it, rather than going against the grain.

Sequencing BER reforms

Few studies attempt to consider the sequencing of policy reforms to encourage formalisation. While advocates such as De Soto argue that simplifying business registration procedures should be a first step, evidence presented in our report from Brazil and Bosnia and Herzegovina shows that simplifying business and tax registration procedures is insufficient, particularly for the agricultural sector where the benefits of formalisation may be low and there may be cultural resistance.

While tax registration reforms have led to improvements in firm level performance and produced economy-wide gains in terms of government revenues, many unregistered business owners and managers remain wary of the cost implications of registering with the tax authority.

Labour law does appear to have an impact on formalisation. Labour laws inappropriately favouring workers at the expense of employers can be a disincentive to expand by employing more workers. In addition, many workers in the agriculture sector are casualised and unprotected. Thus, reform in this field often focuses more on informal workers, which can include child labour, rather than formalisation of employers for the purpose of growth. Despite the huge scope for reforms in this field, it remains inadequately studied.

Land is often seen as a first step, because it can encourage investment and facilitate access to finance. But the evidence on the impact is mixed and interventions can be costly and politically difficult to manage.

Evidence from a variety of programmes shows that the business environment can have a major impact on whether value chain improvements will succeed. These can be particularly important in the agricultural sector, both because it is characterised by raw materials that are perishable and not available throughout the year, which presents a particular risk for investments and because agriculture is often subject to public policy which addresses

concerns around food security and food safety. Value chain upgrading is a common development intervention in the agricultural sector, providing an opportunity to assess the causes of sector informality and to design a programme

response that combines with BER interventions. Access to finance, which can be configured within supply chain support, is a common focus here. However, it is rare to see these programmes deal with broader access to finance and BER.

An area that emerges from the literature across multiple dimensions is the role that cooperatives and business associations can play in facilitating the transition from the informal to the formal sector. Organising agricultural sector enterprises has been shown to facilitate access to credit, through community savings groups and contracting into higher value chains. Organising labour has been shown in other sectors to lead to better working conditions and incomes, although evidence in the agricultural sector is limited.

Economic development and formalisation

Some of the literature suggests that the formal and informal sectors are in competition for resources. As the formal sector expands, it squeezes the informal sector by dragging out resources. However, while the expansion of the formal sector leads to the decline of the informal sector in relative and absolute terms, informal employment can remain high for a long time, especially with high growth in the labour force.

Thus, it is likely that the solution to informality is to ensure prosperous growth of the formal sector, increasing the incentives for transitioning and reallocating resources towards it.

Implications for business environment reforms

It is important to understand the systems that drive and sustain informality. There is a link between formal and informal agricultural sectors. Changes in one can affect the other.

Policy interventions need to carefully consider the intended and unintended consequences of BER on the informal sector.

Most people in developing countries work in the informal sector, and especially in rural, agricultural economies. Informal firms tend to be unproductive and incomes in the sector are suppressed. Anything that increases costs for informal firms or firms graduating towards formality risks aggravating poverty.

Policies designed to promote formality should be introduced with caution, especially where they are based on penalising informality (i.e., the stick approach) rather than increasing formal sector performance (i.e., the carrot approach).

Graduated approaches that encourage the transition to more productive and formalised businesses should be prioritised over regulations, which mandate step changes and can discourage investment and expansion.

Because of its large geographic size and low population density, the rural sector is subject to higher marketing and distribution costs and higher transactions costs of formality. Regulatory and fiscal compliance agencies tend to be far away, and the rural sector’s lower incomes mean official fees are regressive. Likewise, access to public and private services—among the benefits of formality—is less available. Hence, incentives should be provided for the financial sector and increased budgets for the judicial agencies to better service this group. BER should also consider creating rental markets for land and real property, since leasehold tenure can be insecure or there may be restrictions constraining land leasing.